Fannie & Freddie’s UAD 3.6 – An Opportunity for Appraisers

Published by Jason Ferris on

This week, I attended the Train the Trainer Training Program by Fannie Mae and Freddie Mac. The training is focused on the upcoming UAD 3.6 implementation for residential single-unit properties (the industry is updating the term single-family to single-unit, just for clarification). I am thoroughly impressed by the common sense behind this new adaptation, honestly.

To my fellow appraisers, this will be a once in a lifetime opportunity for those of us that complete single-unit appraisals for mortgage lending, which is most of us, quite frankly, to kickstart a true paradigm shift in our industry. I cannot ring this bell loudly enough.

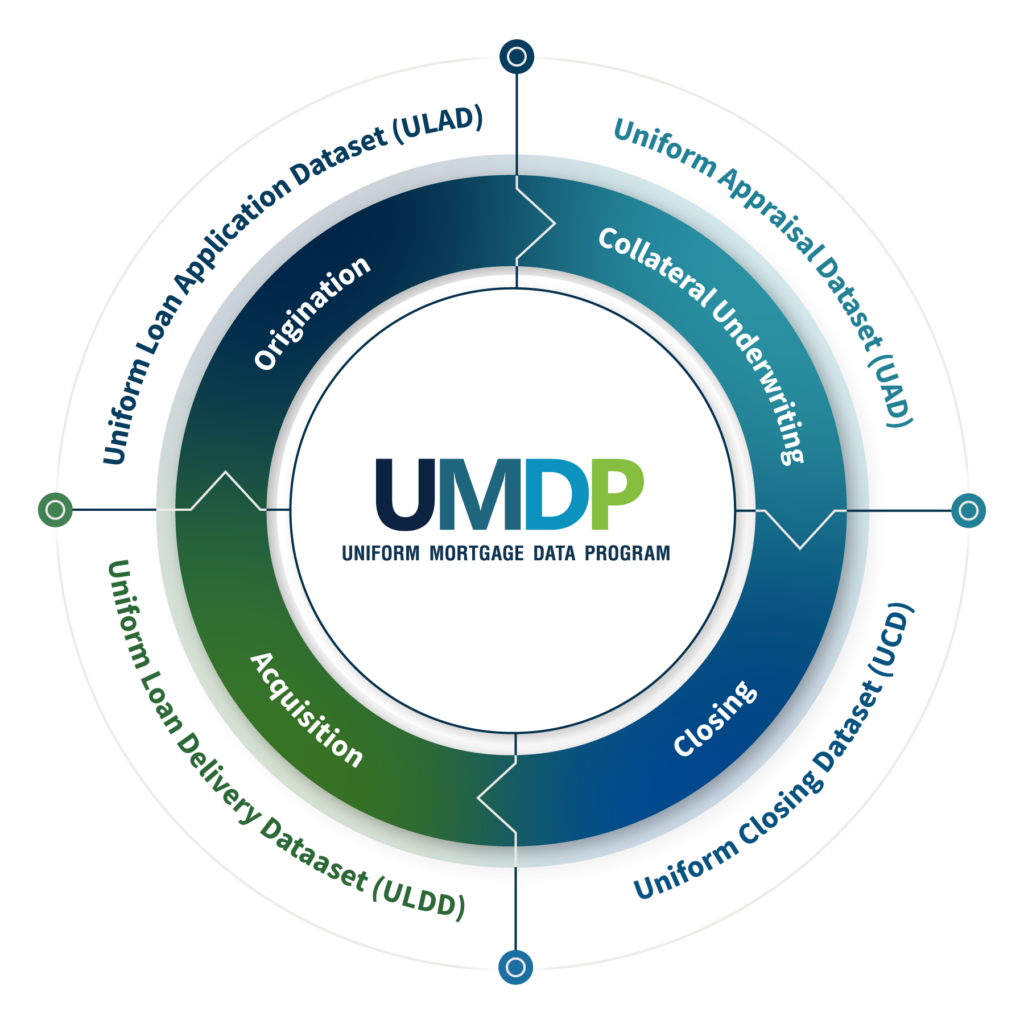

First, some background. Fannie Mae and Freddie Mac developed UAD 2.6, the first version of standardized data collection in residential appraisals, in 2010. From what I recall, most of us began using the new UAD 1004 Form (also known as the URAR) around 2012. It was a shift in the reporting, but not exactly groundbreaking. Essentially, instead of reporting a condition of the subject property or a comparable as “average” or “average+” or “good”, we used 1 of 6 ratings, C1, C2, C3, etc…We did the same for quality and sales dates. But, we are using the same old URAR we’ve used since 2005, the last time it was redesigned.

- September 2025 – January 2026 – Limited Production – Certain lenders will be able to accept and submit the new form to the GSE’s. A small number of appraisers will begin beta-testing the new form.

- January 2026 – November 2026 – Broad Production – All lenders can begin submitting the new form to the GSEs, meaning most appraisers will transition in this period.

- November 2026 – all appraisals for the secondary market will now be mandated to be reported on the new form, all appraisers will be transitioned by this period

- May 2027 – the last UAD 2.6 appraisals will be accepted

For those appraisers that just fill out an appraisal form so it gets through underwriting, who have weak analytical skills, are resistant to change or hate learning new things or adapting new technology, and who are in an endless complaint loop about ‘underwriters’ or ‘Realtors’ or <insert anyone>, it is probably time to retire. I’m not trying to be harsh, but this will require a higher level of skill and analysis than any of us that complete residential appraisals are used to. I’m including myself here too.