Jefferson County Real Estate Tax Assessment 2024 Schedule

Published by Jason Ferris on

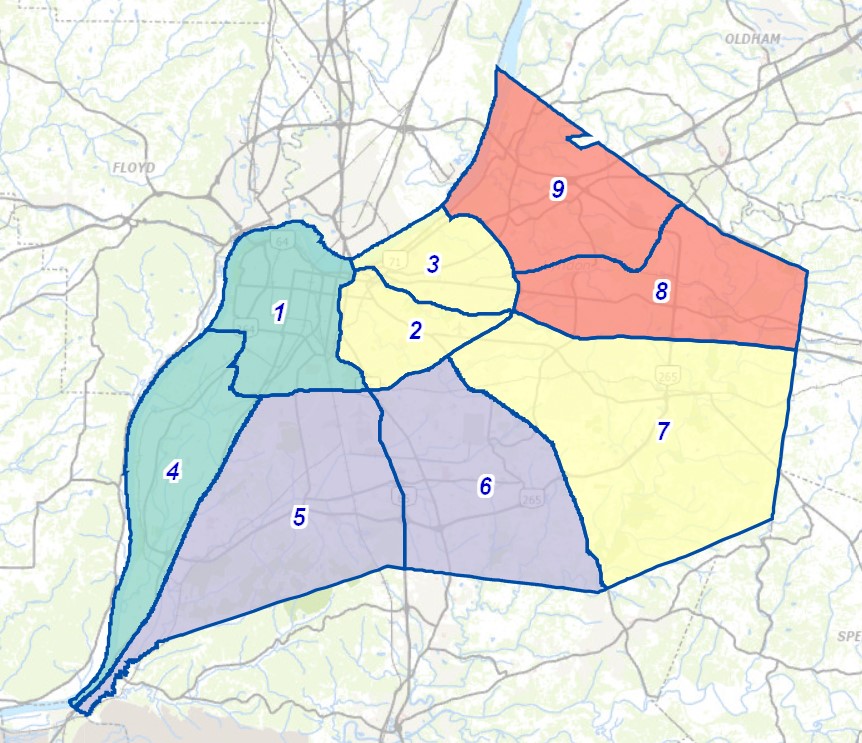

On April 19, 2024, Jefferson County PVA will release reassessments for the 2024 year. This year, the PVA has focused on Areas 2, 3 and 7.

Area 2 includes Cherokee Triangle, Seneca, Highlands, Tyler Park, Germantown, Deer Park, Belknap, Poplar Level, Audubon, Schnitzelburg, Prestonia, Camp Taylor, Bowman, and other neighborhoods.

Area 3 includes Butchertown, Clifton, Brownsboro/Zorn, Crescent Hill, St Matthews, Indian Hills, Cherokee Gardens, Rockcreek, Clifton Heights, Mockingbird Valley, Rolling Fields, and other neighborhoods.

Area 7 includes Jeffersontown, Fern Creek, Forest Hills, Hurstbourne, and other neighborhoods. To find out what area your house is in, click here.

If you want to appeal your taxes, please contact us as soon as you get your assessment.

Step 1 – The online conference step allows the homeowner, or an agent, such as an appraiser or broker, to submit the opinion of value online. That starts April 26th at noon through May 20th at 4 pm. The PVA will review and make a decision to agree or disagree with your opinion of value.

Step 2 – If you don’t agree with the PVA’s decision after the online appeal, you have the ability to attend an in-person hearing, or have an agent attend the hearing on your behalf. You’ll need an appraisal of your property at that point. We can complete the appraisal and testify on your behalf at the hearing.

Please contact us to start the process.